This new piece of machinery costs $500,000 for a three-year lease, but your hope is that your company will operate more efficiently and generate higher cash flows as a result of this new machine. Suppose you as the investor are looking at investing in a project for your company that would extend to you the ownership of a new piece of machinery that may help your business produce widgets more efficiently. This methodology follows from compound interest.

#Discounting cashflows present value plus

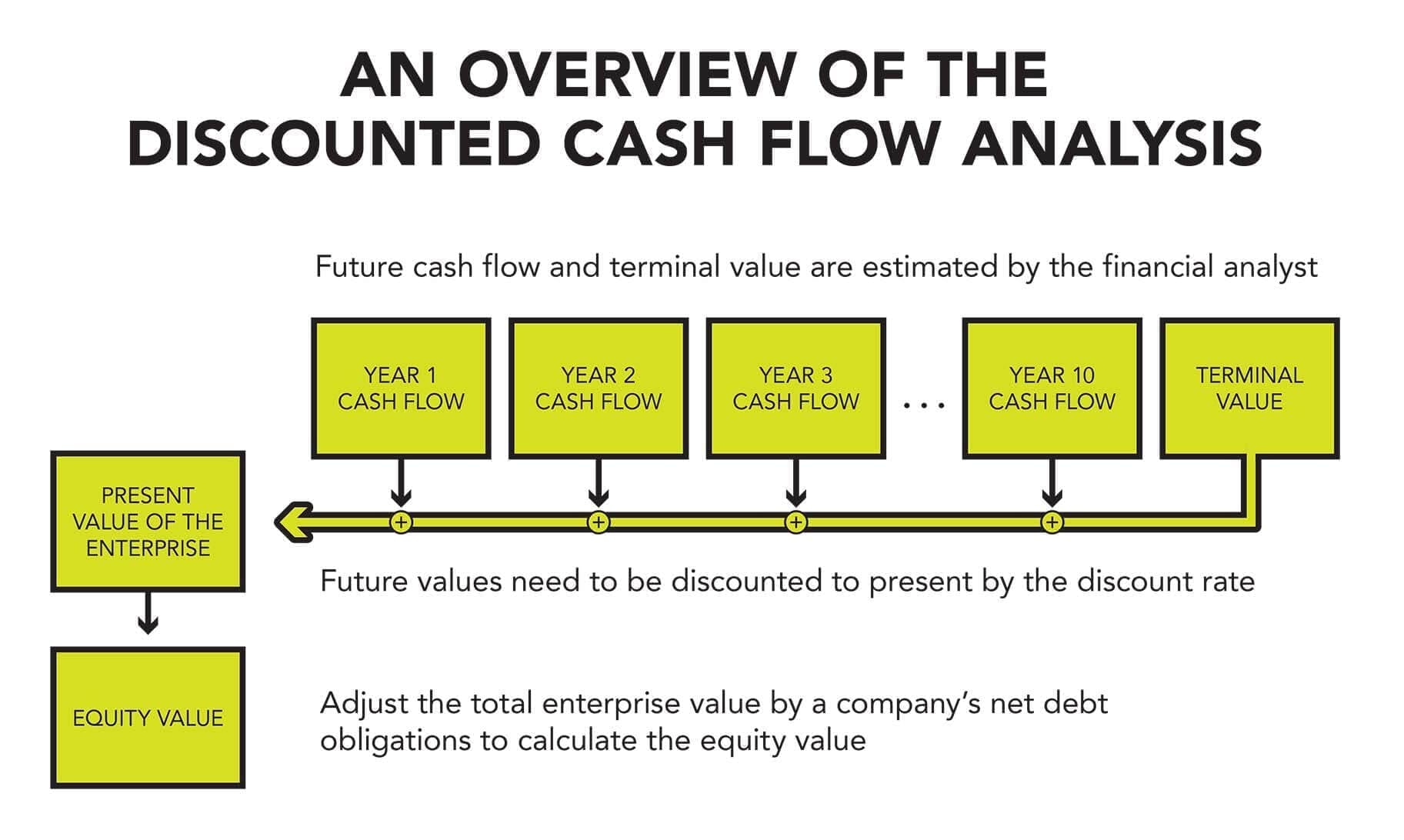

To discount a cash flow, simply divide the cash flow by one plus the discount rate, raised to the number of periods you are discounting. This means that our cash flow for the first time period of the project would be discounted once, the cash flow in the second time period would be discounted twice, and so forth. The way we do this is through the discount rate, r, and each cash flow is discounted by the number of time periods that cash flow is away from the present date. Now, this is not always the case, since cash flows typically are variable however, we must still account for time. This means that the present value of the cash flows decreases.

#Discounting cashflows present value series

Just by thinking of things intuitively by the time value of money, if you have a time series of identical cash flows, the cash flow in the first time period will be the most valuable, the cash flow in the second time period will be the second most valuable, and so forth. The alternative project is investing the dollar, and the rate of return for that alternative project is the rate that your dollar would grow over one year. If you don’t invest that dollar, you will still have that same dollar bill in your pocket next year however, if you invest it, you could have more than that dollar one year from now. The way we calculate the present value is through our discount rate, r, which is the rate of return we could expect from alternative projects. This way of thinking about NPV breaks it down into two parts, but the formula takes care of both of these parts simultaneously. cash you earn from the project, less the present value of all cash outflows, i.e.

:max_bytes(150000):strip_icc()/Presentvalueformula-5c65ebd746e0fb0001befa5b.jpg)

You can think of NPV in different ways, but I think the easiest way is to think of it is as the sum of the present value all cash inflows, i.e.

0 kommentar(er)

0 kommentar(er)